Overview

The US Dollar remains strong due to a lack of new factors, despite slowing momentum. The market is awaiting key data, including the FOMC decision and US elections in early November.

Some believe that the market is gearing up for a Trump win, which could boost the USD due to higher growth expectations and fewer rate cuts. However, not all markets share this outlook.

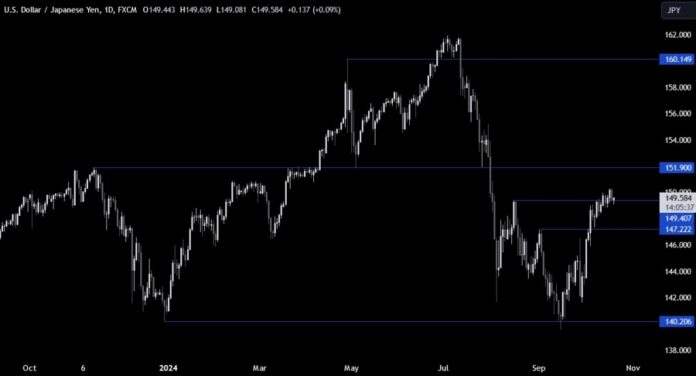

USDJPY Technical Analysis � Daily

On the daily chart, USDJPY is fluctuating around 149.40, with 150.00 acting as resistance. Buyers aim to break above 150.00 targeting 152.00, while sellers look for a drop below 149.00 to potentially reach 147.22.

USDJPY Technical Analysis � 4 Hour

The 4-hour chart shows slowing bullish momentum near 150.00, making it difficult to find clear trading levels due to volatility around 149.40.

USDJPY Technical Analysis � 1 Hour

The 1-hour chart indicates a drop below a minor upward trendline, followed by a bounce above it. A new counter-trendline may attract sellers hoping for a downturn. Buyers will look for a breakout above this level to aim for 152.00.

Upcoming Catalysts

This week is light on data, with important releases coming later. Expect Flash PMIs from Japan and the US on Thursday, along with US Jobless Claims, and Friday will close with the Tokyo CPI report.