Due to slow economic growth and stricter regulations, some Chinese finance professionals are changing careers, according to a new report.

Goldman Sachs recently increased its GDP growth forecast for China from 4.7% to 4.9%, reflecting optimism about the government’s stimulus efforts. However, ongoing regulatory crackdowns on the $67 trillion financial sector are causing investor concerns.

Falling stock prices and reduced earnings are significant worries, intensified by President Xi Jinping�s “common prosperity” initiative, which enforces salary limits and lower bonuses, impacting the financial sector.

For example, Xu Yuhe, a former hedge fund partner, transitioned to helping students study abroad, reflecting a trend toward seeking new opportunities in Hong Kong or Singapore.

Despite a temporary rise in stock values from stimulus measures, Xu believes this won’t last long.

Others, like venture capitalist Wu Shichun, have dramatically shifted to careers like stand-up comedy, using their experiences as material.

The banking industry is also facing scrutiny, with reduced IPO activities. Fewer than half of registered IPO sponsors have completed deals this year.

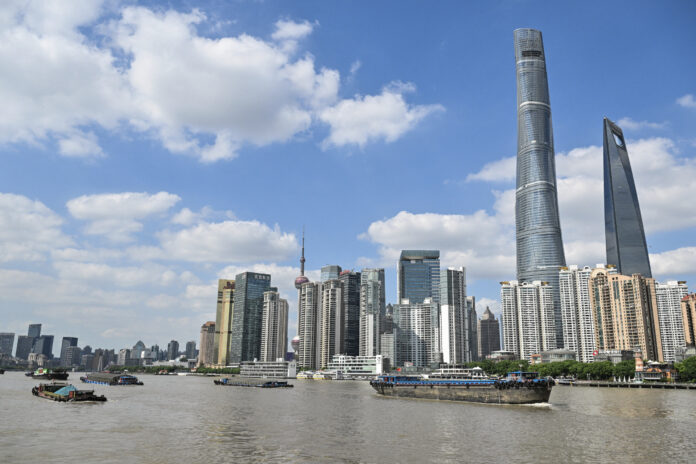

Meanwhile, the People’s Bank of China’s new stimulus measures aim to stabilize the economy by lowering bank reserve requirements, freeing up funds for loans and reducing interest rates on mortgages, to support the struggling real estate market.

`