Overview

The US Dollar has strengthened this week without strong economic data, primarily driven by momentum.

Stanley Druckenmiller mentioned that the market is preparing for a potential Trump victory, as seen in stock movements.

This sentiment might explain the USD’s rise, expecting growth and fewer rate cuts. However, not all markets agree, indicating possible market noise.

Today, we’ll see US retail sales and jobless claims, which could impact the market. Key events will be in November, including the October data and the US election.

The Australian labor market report exceeded expectations, affirming the RBA’s hawkish outlook.

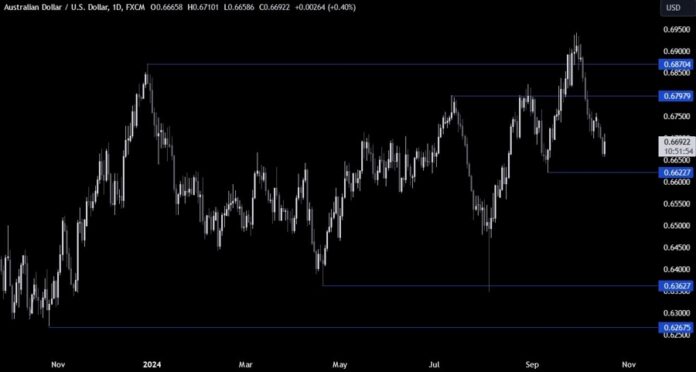

AUDUSD Technical Analysis – Daily

AUDUSD approaches the 0.6622 level. If reached, buyers may enter with support below to target a rise back to 0.68. Sellers will aim to push below this level toward 0.64.

AUDUSD Technical Analysis – 4 Hour

The 4-hour chart shows a tentative break above the downward trendline. Sellers will defend 0.67, but a successful buyer breakout could push to 0.6750.

AUDUSD Technical Analysis – 1 Hour

The 1-hour chart highlights a spike following the strong Australian jobs report. Buyers look for a break above 0.67, while sellers may target new lows. The red lines indicate today’s average daily range.

Upcoming Events

Today, key data releases include US Retail Sales and Jobless Claims.