Fundamental Overview

The People’s Bank of China (PBoC) has announced new easing measures, including rate cuts and stock buyback funding. Positive economic data, such as better-than-expected Retail Sales and Industrial Production, may encourage investors to re-enter the market after last week’s decline.

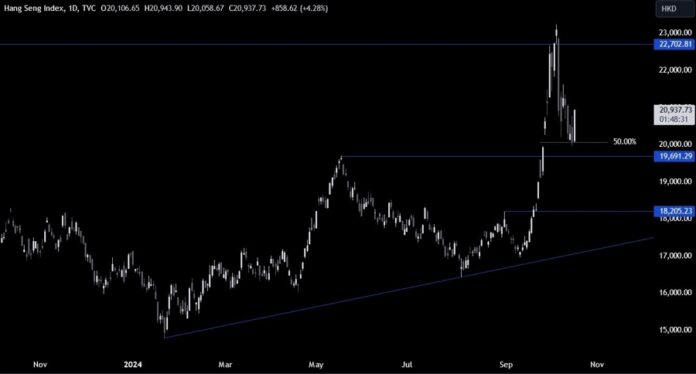

Hang Seng Index Technical Analysis – Daily

The daily chart shows prices bouncing around the 20,000 level, which is also a 50% Fibonacci retracement. The 20,000 to 19,600 range acts as strong support. Buyers could aim for a new cycle high, while sellers need to break this support to push prices down to 18,200.

Hang Seng Index Technical Analysis – 4 Hour

The 4-hour chart indicates a bounce due to the new easing measures. The first target for buyers is the swing level at 21,635, which they need to break to seek new highs. Sellers may target a drop back to the 20,000 support zone.

Hang Seng Index Technical Analysis – 1 Hour

The 1-hour chart shows the price has broken through a minor downward trendline, signaling a potential momentum shift. The price has already hit the upper limit of today’s average range, so new highs may not be reached today. Buyers need to push above 20,781 to target further highs, while sellers might act around these levels to target a decline back to the 20,000 support zone.