Ally Financial ALLY will announce its quarterly earnings on Friday, October 18, 2024. Here’s a quick overview for investors.

Analysts expect an earnings per share (EPS) of $0.53. Investors are looking for good earnings with positive guidance for the next quarter.

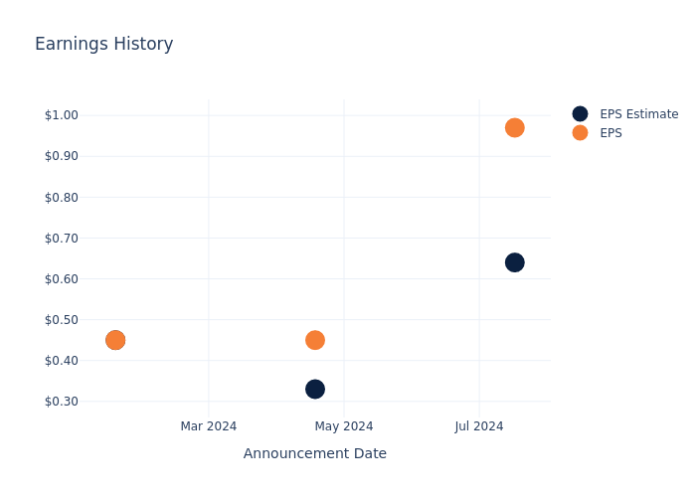

Earnings History

Last quarter, EPS exceeded estimates by $0.33, but the share price fell by 2.28% the next day.

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.64 | 0.33 | 0.45 | 0.80 |

| EPS Actual | 0.97 | 0.45 | 0.45 | 0.83 |

| Price Change % | -2.0% | 1.0% | 11.0% | -4.0% |

Current Stock Performance

As of October 16, Ally Financial’s stock was priced at $35.94, showing a 49.65% increase over the past year. This positive trend suggests long-term investors are optimistic.

Analyst Insights

Investors should keep up with market opinions. The consensus rating for Ally Financial is Outperform, with a one-year price target of $38.78, suggesting a 7.9% potential upside.

Peer Comparison

- Enova International also has an Outperform rating, with an impressive one-year price target of $90.5, indicating a potential 151.81% upside.

Key Metrics: Peer Analysis

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Credit Acceptance | Sell | 12.42% | $330.70M | -2.94% |

| Enova International | Outperform | 25.83% | $299.24M | 4.69% |

Key Takeaway: Ally Financial performs better than peers in Revenue Growth and Gross Profit but lags in Consensus and Return on Equity metrics.

About Ally Financial

Ally Financial, once part of General Motors, became independent in 2014. It specializes in auto lending, with over 70% of its loans focused on consumer auto loans. The company also provides auto insurance, commercial loans, credit cards, and mortgages.

Financial Overview

Market Cap: Lower than the industry average, potentially due to modest growth expectations.

Revenue dip: A decline of about -4.37% in revenue growth as of June 30, 2024.

Net Margin: Strong at 12.29%, indicating effective cost management.

Return on Equity: Low at 2.33%, presenting challenges in capital efficiency.

Debt Management: A debt-to-equity ratio of 1.53, showing less reliance on debt financing, which is positive for investors.

To track Ally Financial’s earnings releases, visit our earnings calendar.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

`