Market Summary

The US Dollar’s upward momentum appears to be slowing, even after strong US CPI and PPI reports. The market has already aligned with the Fed’s expectations for rate cuts, leaving fewer aggressive cut scenarios.

More strong data from the US is needed to trigger speculation about an earlier pause in rate cuts, which could support the Dollar.

Long-term US yields are likely to rise, keeping the USD trend intact. Additional bullish factors would strengthen buyer confidence.

Key events to watch in November include October data releases and the US elections.

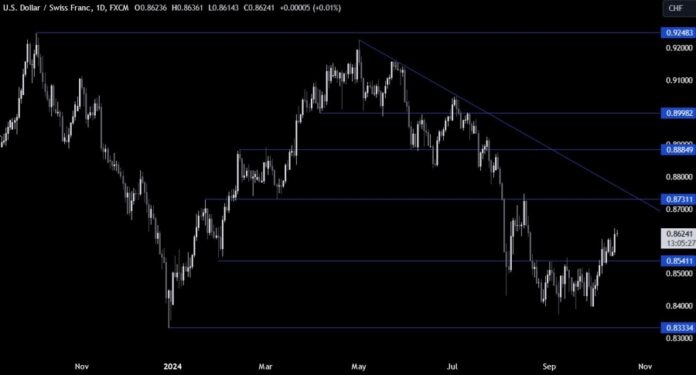

USDCHF Technical Analysis – Daily Chart

On the daily chart, USDCHF recently hit a new high, but without a clear catalyst. The primary target for buyers is the 0.8730 resistance, while sellers are watching for a fall below 0.8550 to target 0.8333.

USDCHF Technical Analysis – 4 Hour Chart

The 4-hour chart shows an upward trendline supporting the bullish momentum. Buyers are likely to rely on this trend. Sellers will look for a breakdown below this support, targeting 0.8333.

USDCHF Technical Analysis – 1 Hour Chart

The 1-hour chart indicates price consolidation just above the former resistance-turned-support at 0.86. Buyers may enter with risk defined below this support, while sellers will watch for a breakdown towards the trendline.

Upcoming Data Points

This week features limited economic data, with key releases coming Thursday for US Retail Sales and Jobless Claims.