Overview

The US Dollar’s strong momentum is fading, even with recent higher-than-expected CPI and PPI reports. The market has adjusted its expectations for aggressive rate cuts to align with the Federal Reserve’s projections.

More favorable US data is needed for the market to consider pausing the Fed’s easing cycle, which could strengthen the dollar further. Important events to watch for in November include the October data release, the FOMC policy decision, and the US election.

For the Australian Dollar (AUD), the RBA remains hawkish, though this was slightly softened in the last meeting. Tomorrow’s Australian labor market report is expected, but significant deviations from expectations are needed to impact pricing.

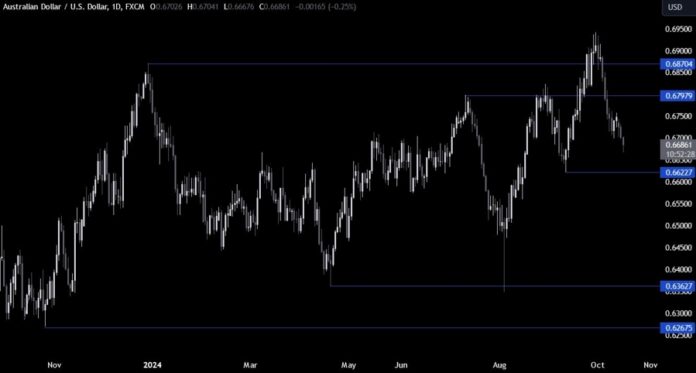

AUDUSD Technical Analysis – Daily

On the daily chart, AUDUSD is still dropping, but momentum is slowing. Sellers target the 0.6622 level, where buyers may enter with a predefined risk to aim for a rally to 0.68.

AUDUSD Technical Analysis – 4 Hour

The 4-hour chart shows a downward trendline indicating bearish momentum. Sellers are likely to continue pushing for further declines, while buyers need a price breakout to target higher levels.

AUDUSD Technical Analysis – 1 Hour

The 1-hour chart reveals price action with a trendline forming a strong resistance around 0.67. Buyers need to break above this level to aim for new highs, while sellers anticipate a rejection to push for new lows. The red lines represent today’s average daily range.

Upcoming Events

Tomorrow, we have the Australian Labor Market report, along with US Retail Sales and Jobless Claims data.