Fundamental Overview

The US Dollar’s bullish momentum is fading despite recently high US CPI and PPI reports. The market has adjusted its expectations for rate cuts, aligning closely with the Fed’s projections.

More strong US data is needed to influence market expectations regarding the Fed’s easing cycle and boost the US Dollar further. Key events to watch in November include the October data release, the FOMC meeting, and the US elections.

In Europe, the ECB is expected to cut rates by 25 bps tomorrow, with another cut forecasted in December and four more anticipated in 2025.

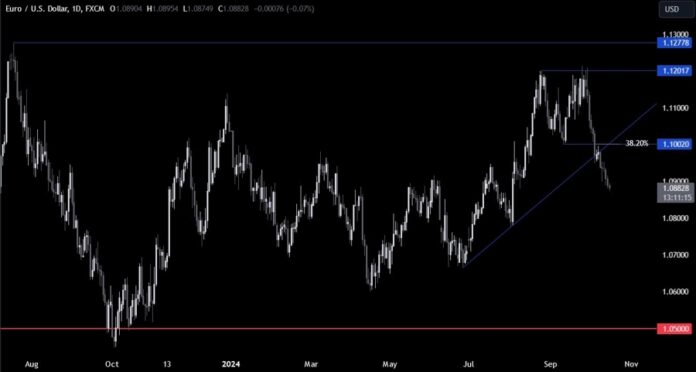

EURUSD Technical Analysis – Daily Timeframe

The daily chart shows a continued drop in EURUSD, but momentum is slowing. Sellers may find better risk-to-reward opportunities around 1.10, near the 38.2% Fibonacci retracement level. Buyers will look for a break above 1.10 to target 1.12 next.

EURUSD Technical Analysis – 4 Hour Timeframe

The 4-hour chart reveals a downward trendline indicating bearish momentum. Sellers may continue to lean on this trendline, while buyers will be looking for a break higher to target the 1.10 resistance level.

EURUSD Technical Analysis – 1 Hour Timeframe

The 1-hour chart indicates that aggressive buyers may enter if the price breaks above the recent lower high at 1.0895. The red lines show today’s average daily range.

Upcoming Catalysts

Tomorrow, look out for the ECB Rate Decision, US Retail Sales, and Jobless Claims data.