Fundamental Overview

The US Dollar’s bullish momentum is slowing, despite recent positive US CPI and PPI reports. Rate cut expectations are now aligned with the Fed’s forecasts.

More strong US data is needed for the market to consider an earlier pause in the Fed’s easing cycle, which could further support the US Dollar.

Long-term US yields are expected to rise, maintaining the USD’s upward trend. Upcoming risks include the October data release and the US election in November.

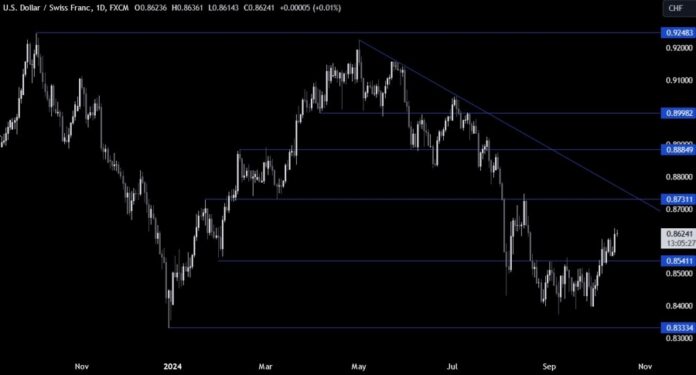

USDCHF Technical Analysis � Daily Timeframe

The daily chart shows USDCHF reaching a new high, with a key resistance at 0.8730. Sellers will look for a drop below 0.8550 towards 0.8333.

USDCHF Technical Analysis � 4 Hour Timeframe

An upward trendline indicates bullish momentum on the 4-hour chart. Buyers may continue to push for higher prices, while sellers seek a break below for a decline to 0.8333.

USDCHF Technical Analysis � 1 Hour Timeframe

The 1-hour chart shows price consolidating above recent support at 0.86. Buyers may enter here with cautious risk below support for potential new highs, while sellers watch for a break below.

Upcoming Catalysts

This week has few key economic releases, with highlights including US Retail Sales and Jobless Claims data on Thursday.