In August 2013, Sprouts Farmers Market (SFM -0.69%) had a strong IPO, with shares closing at $40 on the first day – more than doubling their initial price. This made it one of the most exciting IPOs since LinkedIn.

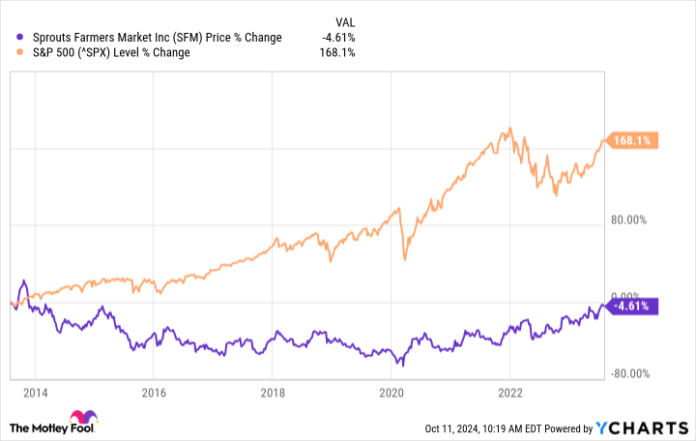

However, by August 2023, SFM shares hovered around $38, showing little growth over a decade, significantly trailing behind the S&P 500.

Those who sold SFM stock during those stagnant years might feel justified, yet shares have jumped about 200% in the year following its 10-year mark as a public company. Here’s why.

Why Sprouts is a Hot Stock

Sprouts operates 415 grocery stores as of mid-2024, focusing on fresh produce and healthy items. In the first half of 2024, revenue grew by 10% with a 7% operating margin.

These figures are consistent; Sprouts has seen double-digit revenue growth since its IPO in 2013, with an operating margin often better than competitors’.

Despite solid fundamentals, the stock plummeted in value, prompting share buybacks. As a result, the total number of shares decreased while earnings per share (EPS) increased, leading to renewed investor interest.

Why the Sudden Interest?

The stock market can behave irrationally, often waiting years to reflect a company’s growth in stock prices. But Sprouts has finally been recognized, highlighting the importance of patience in investing.

Looking Ahead for Sprouts Stock

Sparks plans to open over 100 new stores, which should boost revenue. Management forecasts a 4% to 5% growth in same-store sales this year, with potential double-digit revenue growth in the coming years.

Sprouts is now debt-free and has consistently posted positive operating income, making it a safer investment.

While it may not triple again in value immediately, steady growth should lift the stock price over time. With strong profits and no debt, patience could lead to rewarding long-term investments.

`