By RoboForex Analytical Department

USD/JPY is having trouble moving past the resistance point at 149.55 after several attempts in the last five trading sessions. The Japanese yen is under pressure as the Federal Reserve hints at a less aggressive pace for interest rate cuts compared to what many expected.

China’s recent plans for more financial support have failed to boost market confidence. Finance Minister Lan Fo’an announced plans to inject more capital into state banks and assist the property sector, but vague details left investors unsure about the impact of these measures.

In Japan, comments from Bank of Japan Governor Kazuo Ueda and new Prime Minister Shigeru Ishiba’s opposition to further rate hikes are adding to the yen’s problems. Ishiba recently voiced that the economy doesn’t support more rate increases, but later comments by officials suggested disagreement within the government on monetary policy.

Technical Analysis Of USD/JPY

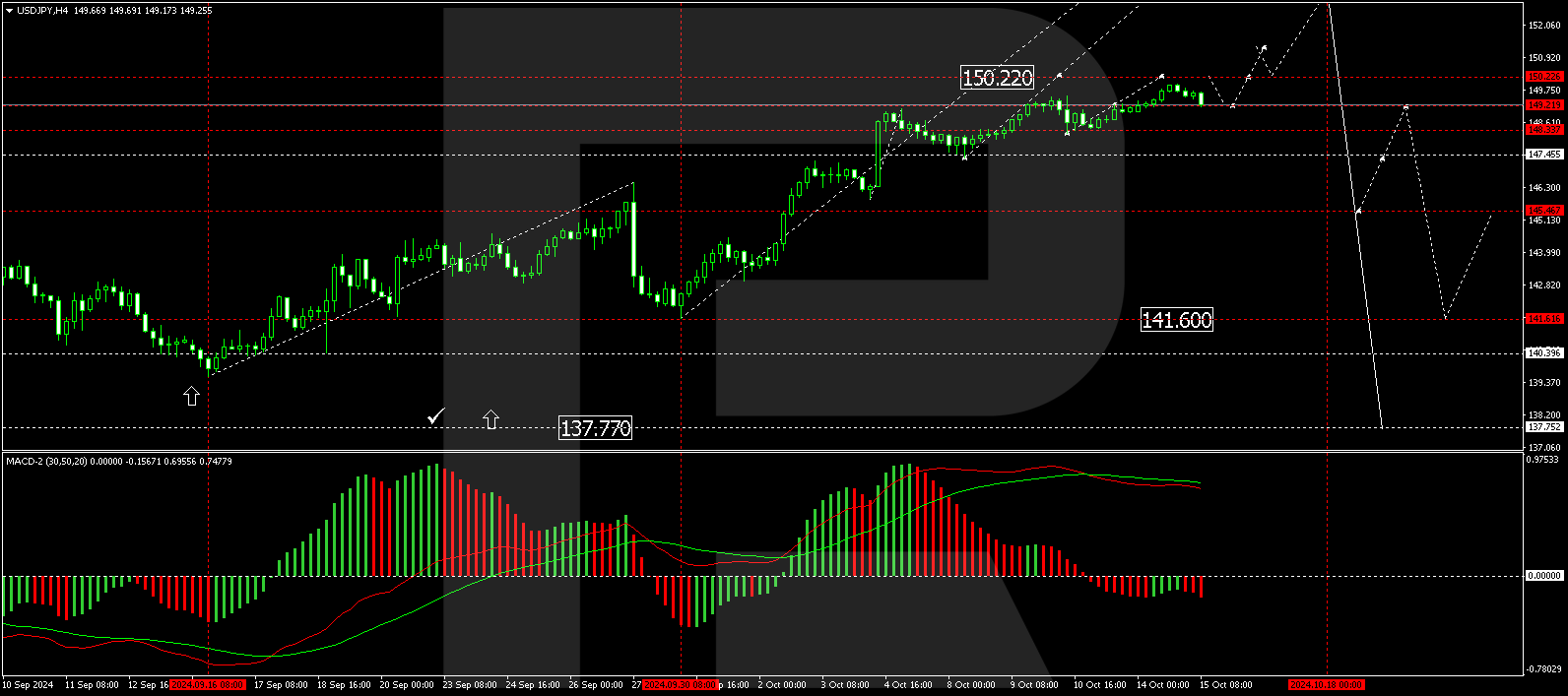

The USD/JPY pair is currently consolidating around 149.22, with a range now extending to 149.96. If it rebounds from 149.22, it could rise to 150.22, with a further increase towards 153.22 possible if it breaks that level. However, if it drops below 148.88, a decline to 147.47 may occur. The MACD indicator also suggests a potential shift in momentum.

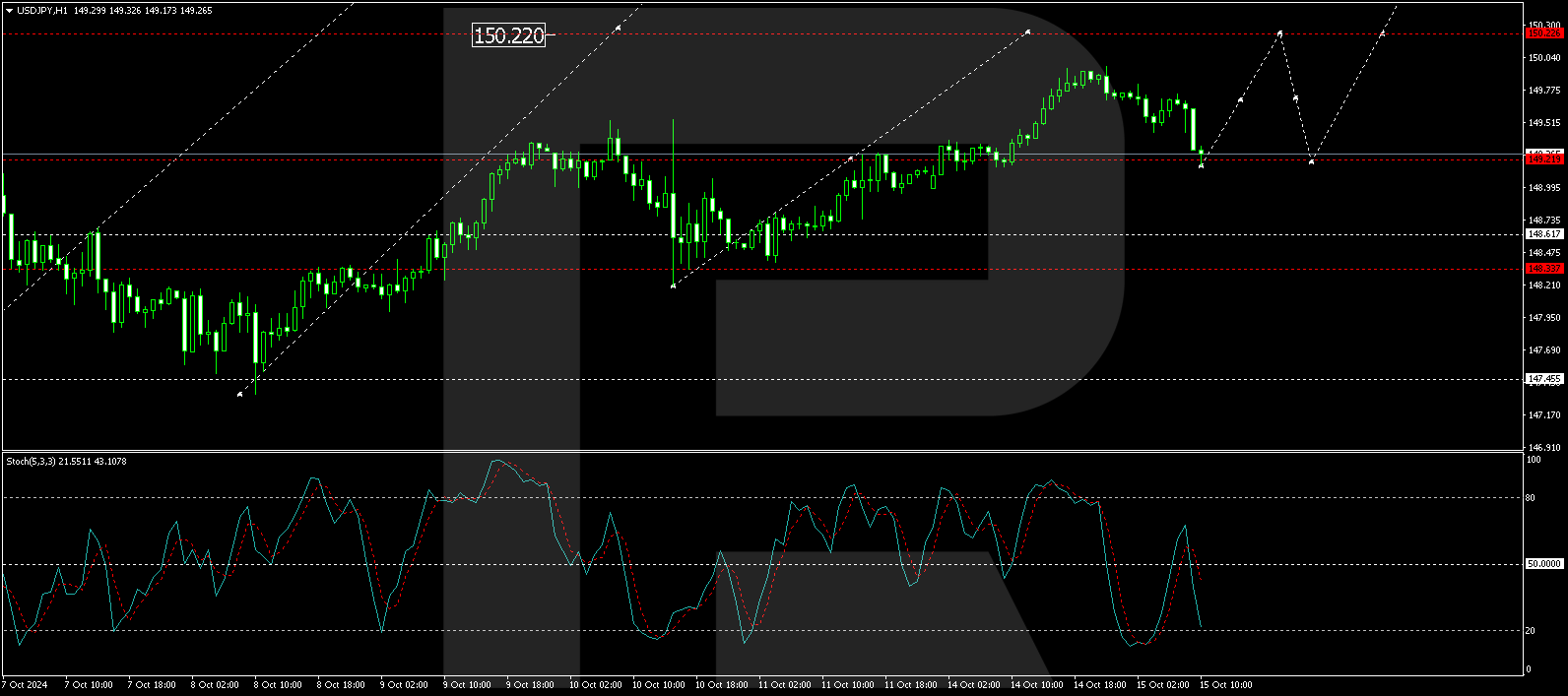

On the hourly chart, USD/JPY has risen to 149.96 and is now correcting back to 149.22. After this correction, it is expected to continue upward to 150.22, aligning with the upward trend seen in the Stochastic oscillator.

Disclaimer

Any forecasts here are the author’s opinions and should not be taken as trading advice. RoboForex isnít responsible for any trading results based on this analysis.

This article is from an unpaid external contributor and has not been edited for content or accuracy by Benzinga.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

`