By RoboForex Analytical Department

The USD/JPY pair is correcting after two days of gains due to mixed economic signals from Japan. While there are expectations for the Bank of Japan (BoJ) to tighten monetary policy, the yen is under pressure from slowing inflation, which may lessen the immediate need for rate hikes.

In September, Japan’s consumer prices rose by 2.5% year-on-year, down from 3.0% in August, marking the first decline since March and the lowest level since April. The core inflation index, important for the BoJ, increased by 2.4%, down from 2.8%, but has stayed above the BoJ’s 2.0% target for 30 months. Inflation excluding food and energy was 2.1%, slightly up from 2.0% in August.

BoJ board member Seiji Adachi recently noted a preference for moderate rate changes due to global economic uncertainty and slow wage growth domestically. The yen’s weakness is under scrutiny, with Japan’s top currency diplomat, Atsushi Mimura, emphasizing the government’s attention to exchange rate fluctuations and excessive volatility.

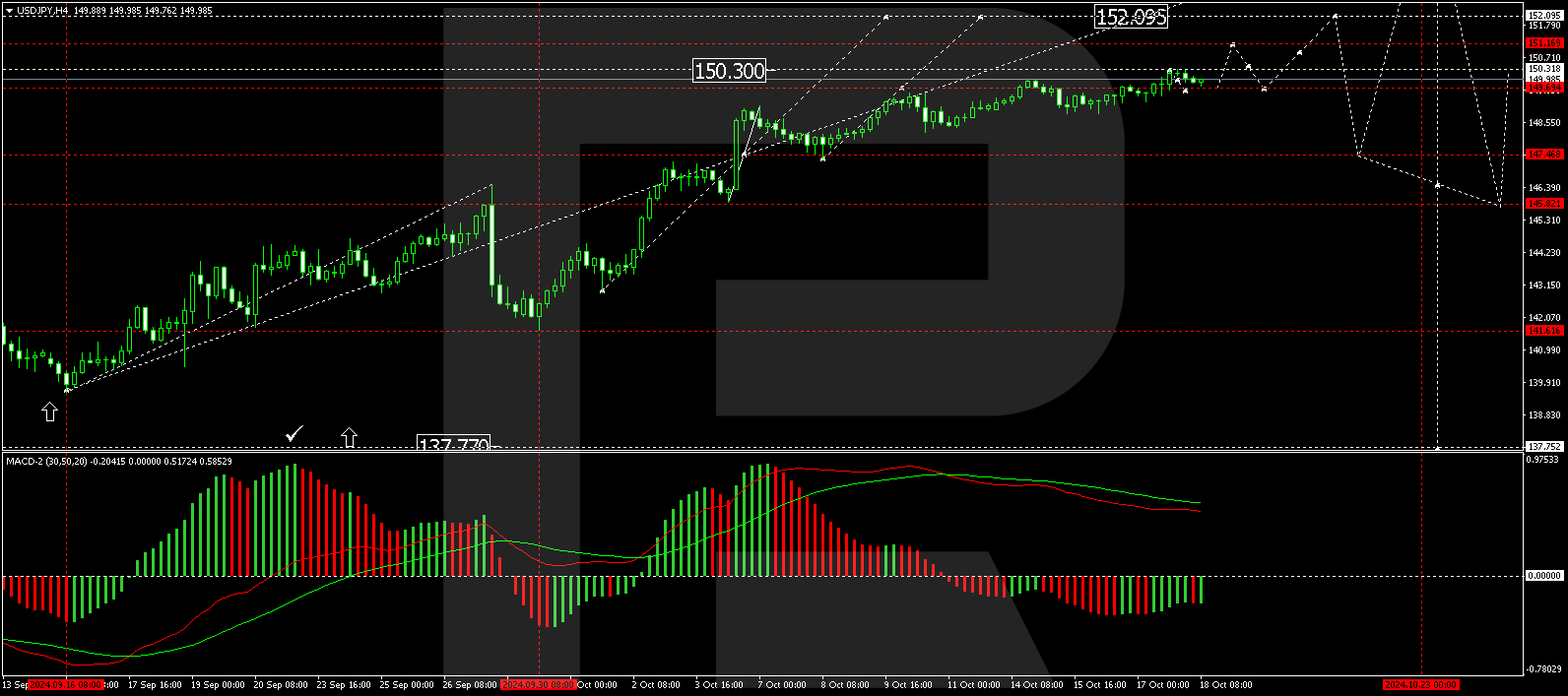

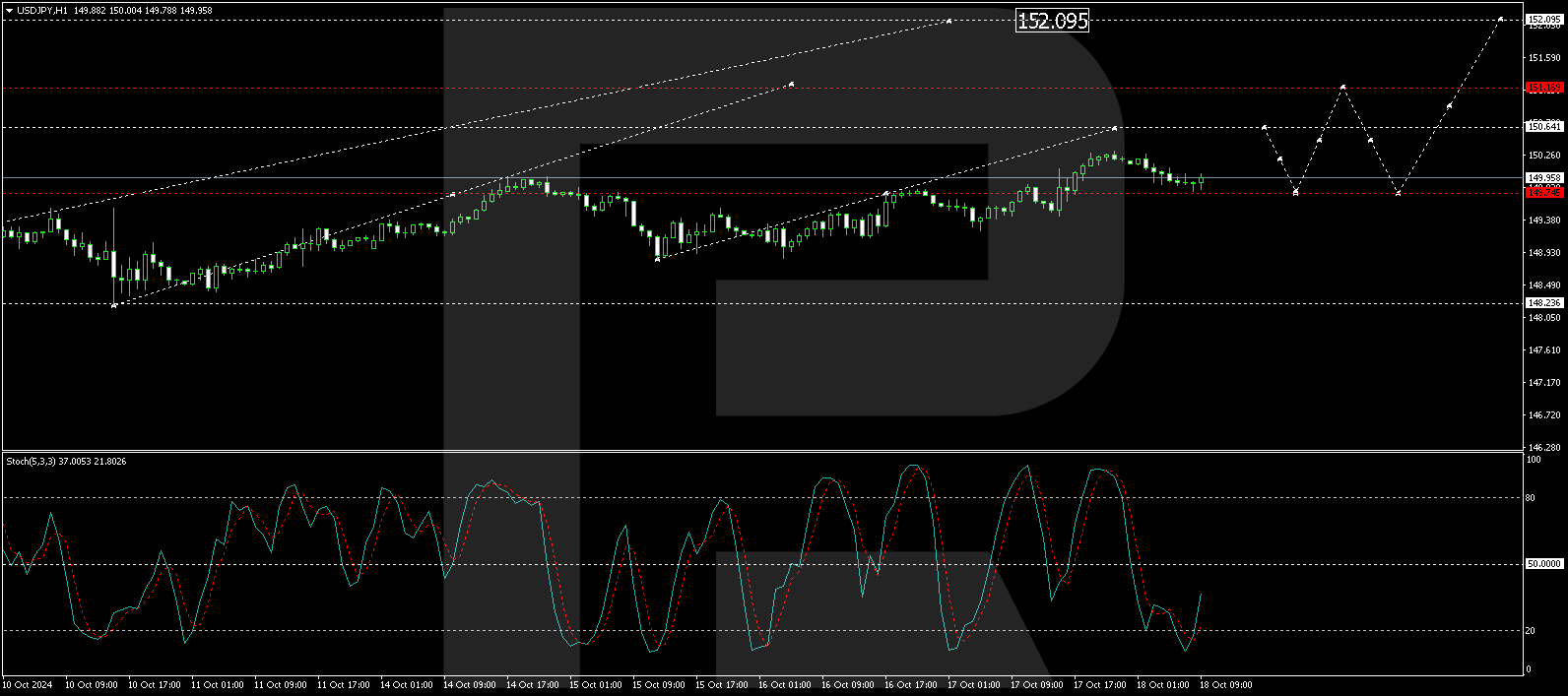

USD/JPY Technical Analysis

The USD/JPY reached a peak of 150.30 and is now testing the 149.75 level. A successful move above 151.15 could lead to a rise towards 152.09. Meanwhile, if it drops below 149.70, it might decline to 147.70. The MACD indicator suggests upward momentum as its signal line is above zero and looks poised to rise further.

On the hourly chart, USD/JPY has consolidated between 149.75 and 150.30. Current trends suggest it may correct back to 149.75 before potentially rising to 150.65, setting up for a rise to 151.15. This outlook is supported by the Stochastic oscillator, which indicates strengthening upward momentum.

Disclaimer

Any forecasts here are based on the author’s opinion and not trading advice. RoboForex is not responsible for any trading results from this analysis.

This article is from an unpaid external contributor. It does not reflect Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

`