Fundamental Overview

The USDJPY pair’s bullish momentum is fading, despite recent stronger US CPI and PPI data. Expectations for aggressive rate cuts have diminished and align closely with the Fed’s outlook.

More robust US data is needed for the market to consider an earlier pause in the Fed’s easing cycle, which could support the US Dollar further.

In the long term, US yields are likely to rise, maintaining an uptrend in USDJPY. Additional catalysts for a stronger dollar would encourage buyers.

Key upcoming events in November include the release of October data and the US election.

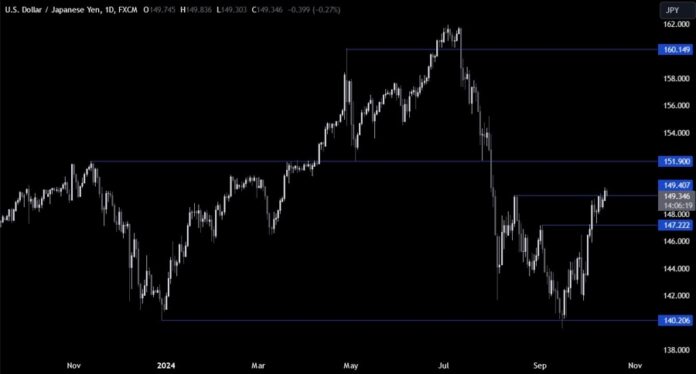

USDJPY Technical Analysis – Daily Timeframe

The daily chart shows USDJPY briefly surpassed the key level of 149.40 but couldn’t maintain the breakout. Sellers may look to drive the price back to 147.22, while buyers want to see a recovery above the swing level to target 152.00.

USDJPY Technical Analysis – 4 Hour Timeframe

The 4-hour chart indicates a rising wedge formation around 150.00. Sellers seek a downside break to target 147.22, while buyers may rely on the bottom trendline to attempt new highs.

USDJPY Technical Analysis – 1 Hour Timeframe

The 1-hour chart reveals price action within the existing pattern. Sellers anticipate a break below, while buyers hope for a bounce at the bottom trendline. The red lines indicate today’s average daily range.

Upcoming Catalysts

This week has few key economic releases, including US Retail Sales and Jobless Claims on Thursday, followed by Japanese CPI on Friday.