Fundamental Overview

The US Dollar remains stable despite slowing momentum due to a lack of market catalysts. Attention is now on early November for key economic data, the FOMC decision, and the US elections.

Some market analysts suggest that investors are positioning for a Trump victory, which could strengthen the USD due to anticipated growth and fewer expected rate cuts. However, not all markets share this outlook.

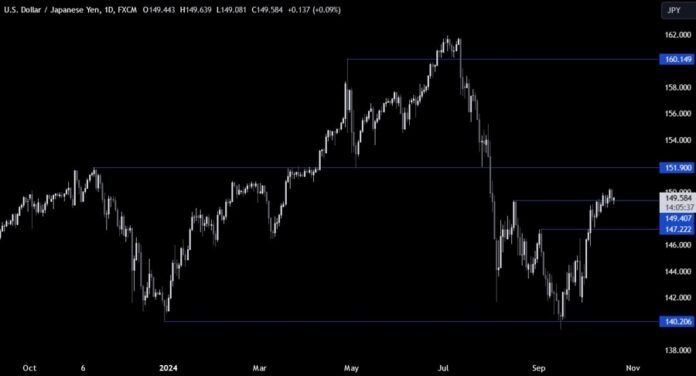

USDJPY Technical Analysis � Daily Timeframe

On the daily chart, USDJPY is fluctuating around 149.40, with 150.00 acting as resistance. Buyers want to see a breakout above 150.00, targeting 152.00. Sellers will look for a drop below 149.00 to aim for 147.22.

USDJPY Technical Analysis � 4 Hour Timeframe

The 4-hour chart shows slowing bullish momentum near 150.00, making it difficult to find clear trading levels due to choppy price action around 149.40.

USDJPY Technical Analysis � 1 Hour Timeframe

The 1-hour chart indicates that the price fell below a minor upward trendline but bounced back. Sellers may use a new counter-trendline to target lower prices, while buyers hope for a breakout above current levels to rally towards 152.00.

Upcoming Catalysts

This week is light on economic data, with notable releases expected later in the week. Thursday features Flash Japanese and US PMIs and US Jobless Claims. On Friday, we have the Tokyo CPI report.