Overview

The US Dollar is strengthening this week, largely due to market momentum, despite fewer economic reports and lower Treasury yields.

Investor Stanley Druckenmiller mentioned that the market may be anticipating a Trump win, as seen in the actions of certain stocks like DJT.

This expectation could be boosting the USD, which benefits from expectations of growth and fewer anticipated rate cuts. However, not all markets align with this view, indicating potential volatility.

Today’s retail sales and jobless claims reports may influence the market, but the major impacts are expected in November with October data and the US elections.

For Canada, the recent CPI fell short of expectations, increasing the likelihood of a 50 bps rate cut at the next meeting, with the odds now at 73%.

The Canadian Dollar (Loonie) rose after this data release, potentially due to a “sell the fact” response, as the market had anticipated significant rate cuts.

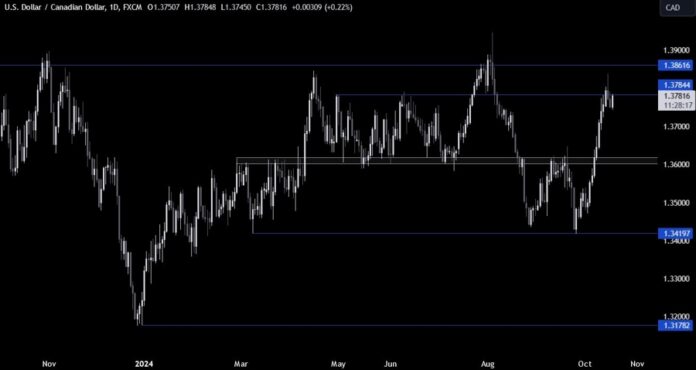

USDCAD Analysis – Daily Chart

On the daily chart, USDCAD fell below the critical 1.3785 level after the CPI report. Sellers may aim for a drop to 1.36 support, while buyers seek a breakout past 1.3785 to aim for 1.39.

USDCAD Analysis – 4 Hour Chart

The 4-hour chart shows the price breaking below a crucial trendline. Sellers are targeting new lows while the price tests the 1.3785 level again.

USDCAD Analysis – 1 Hour Chart

The 1-hour chart highlights resistance around 1.3785. Buyers seek a breakout, while sellers anticipate a downturn.

Upcoming Events

Today’s US Retail Sales and Jobless Claims data are set to impact the market.