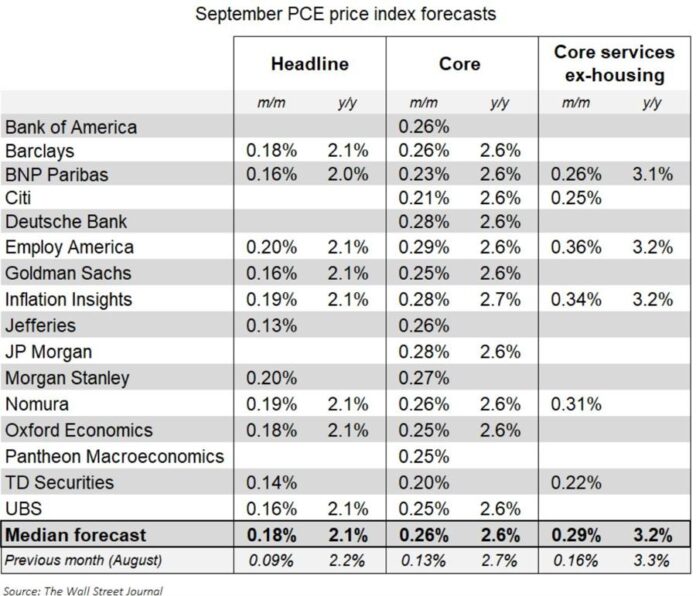

Nick Timiraos from the Wall Street Journal provides insights on PCE inflation forecasts.

Timiraos notes:

- September’s core inflation forecast is around 0.26%, slightly below the CPI’s 0.31%, but the highest monthly rise since March.

- This would decrease the 6-month annualized rate to 2.2% (from 2.4%) and the year-over-year rate to 2.6% (from 2.7%).

- Year-over-year headline PCE is expected to fall to 2.1%.

The data will be released on October 31.

Goldman Sachs is optimistic, stating that PCE data suggests the Fed has already met its 2% inflation target.

PCE is a key measure of inflation, tracking price changes for consumer goods and services, reported monthly by the Bureau of Economic Analysis (BEA). The Federal Reserve relies on it for monetary policy decisions.

There are two main PCE types:

- Headline PCE: Measures overall price changes, including volatile food and energy prices.

- Core PCE: Excludes food and energy prices for a clearer view of long-term inflation trends, favored by the Federal Reserve.

PCE is broader than the Consumer Price Index (CPI) and reflects changing consumer behaviors in response to price fluctuations.