Fundamental Overview

Last week, gold dropped to a trendline as prices adjusted to rising real yields after the strong US NFP report. Even with higher-than-expected US CPI and PPI data, the market still anticipates rate cuts, allowing gold to restart its uptrend. Overall, gold remains in a bullish trend as real yields are likely to fall with the Fed’s easing cycle. Any pullbacks could be driven by changes in rate cut expectations, but the uptrend should remain unless the Fed adjusts its policy.

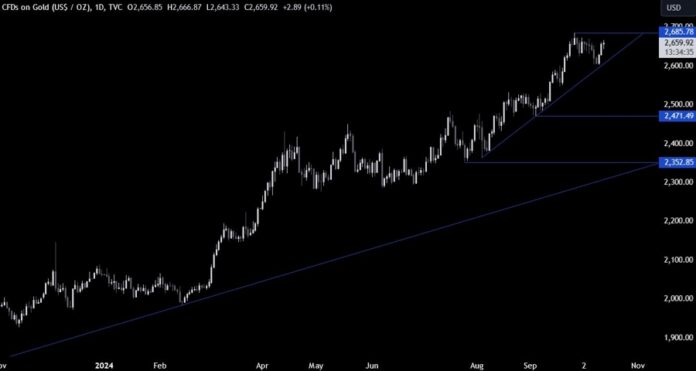

Gold Technical Analysis – Daily Timeframe

On the daily chart, gold bounced off a key trendline and rose to 2666. The next target is the all-time high around 2685. Buyers want to break above this to push higher, while sellers are looking for a drop below the trendline to target a fall to 2500.

Gold Technical Analysis – 4 Hour Timeframe

In the 4-hour chart, gold broke above a counter-trendline. Buyers are expected to enter at these levels aiming for the all-time high. Sellers will look for a drop back below this trendline to target further declines.

Gold Technical Analysis – 1 Hour Timeframe

The 1-hour chart shows a minor upward trendline indicating the current bullish momentum. Buyers are expected to lean on this trendline for support, while sellers will target a break lower for a potential drop towards the major trendline. The red lines show today’s average daily range.

Upcoming Catalysts

This week is light on data except for a few key releases. Today features a speech from the Fed’s Waller, and on Thursday, we have US Retail Sales and Jobless Claims data scheduled for release.