Fundamental

Overview

The US Dollar has been supported recently due to a lack of catalysts, despite a slowdown in momentum. Market focus is now shifting to the first weeks of November, which will see key economic data, the FOMC decision, and the US elections.

There is a belief that markets are preparing for a Trump victory, which could strengthen the USD on expectations of higher growth and fewer rate cuts. However, not all markets share this view.

Last week, the ECB cut interest rates as expected but did not provide new forward guidance. The central bank remains data-dependent and has not committed to a specific rate path.

The market is anticipating an 86% chance of another 25 bps rate cut in December, with a 14% probability of a larger 50 bps cut. Looking ahead, the market predicts four more rate cuts by the ECB in 2025.

EURUSD Technical

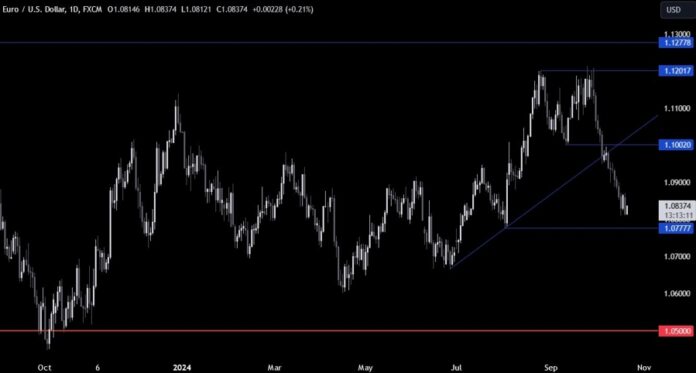

Analysis � Daily Timeframe

On the daily chart, EURUSD has extended its drop towards the 1.08 level. The price is approaching a key support at 1.0777, where buyers may step in to position for a rally towards 1.10. Sellers, on the other hand, will look for a break below 1.0777 to increase bearish bets towards 1.06.

EURUSD Technical

Analysis � 4 hour Timeframe

On the 4-hour chart, the pair is trading within a falling channel. A pullback is occurring, and if the price reaches the channel’s top, sellers may push it lower. Buyers will aim for a break above the channel to target 1.10.

EURUSD Technical

Analysis � 1 hour Timeframe

On the 1-hour chart, a quick selloff occurred yesterday due to pressure from rising Treasury yields. The market is recovering, aiming to return to the channel’s top. Currently, there is a range between support at 1.0810 and resistance at 1.0870, with sellers targeting 1.0777 and buyers aiming for 1.10.

Upcoming

Catalysts

This week is relatively quiet regarding data releases, with significant events expected later in the week. Thursday will see the release of the Flash Eurozone and US PMIs, as well as US Jobless Claims figures.