A different perspective on the ECB’s recent rate cut: PIMCO noted that although the European economy is weaker than expected, risk management governs central bank choices.

- PIMCO analysts warn that any unexpected inflation might prompt the ECB to slow its rate cuts, but the recent reduction also acts as a buffer against potential risks.

- Despite ongoing inflation driven by service sector costs, PIMCO believes the ECB will keep a tight monetary policy for now.

- They stress that upcoming economic data will be key in deciding how fast the ECB could relax its policies.

- PIMCO forecasts discussions next year on the neutral policy rate by the ECB�s Governing Council, especially if rates fall below 3%.

- They expect another rate cut in December and find market predictions of a terminal rate around 1.85% in late 2024 reasonable.

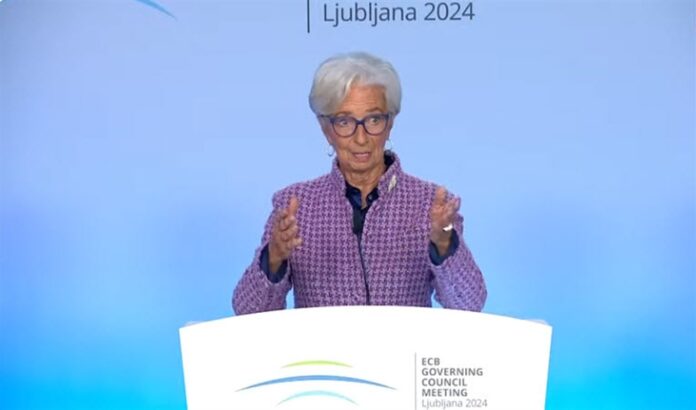

European Central Bank President Lagarde