Fundamental Overview

The US Dollar’s strong performance is starting to fade, even with recent high CPI and PPI reports. The market has adjusted expectations regarding rate cuts to align more closely with the Fed’s guidance.

More strong US data will be needed for the market to anticipate a pause in the Fed’s easing and strengthen the US Dollar further. Key events in November will include the October data, FOMC policy decision, and the US elections.

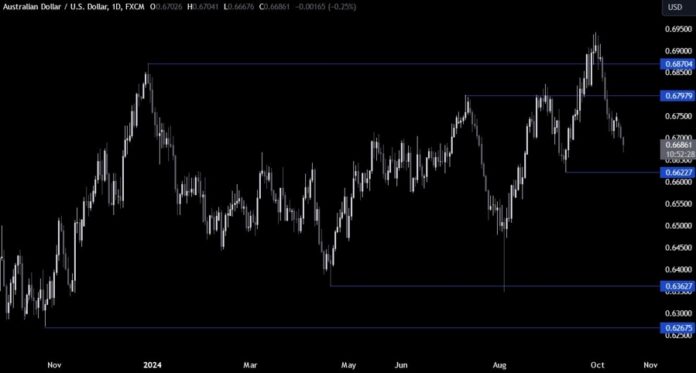

AUDUSD Technical Analysis – Daily Timeframe

AUDUSD is still on a downward trend, but momentum has slowed. Sellers should target the 0.6622 level, where buyers may enter, hoping for a rebound towards 0.68.

AUDUSD Technical Analysis – 4 Hour Timeframe

The 4-hour chart shows a downward trendline indicating ongoing bearish momentum. Sellers are likely to continue pushing down, while buyers will look for a breakout to aim for higher prices.

AUDUSD Technical Analysis – 1 Hour Timeframe

On the 1-hour chart, the trendline serves as a strong resistance level near 0.67. Buyers need to break this level for highs, while sellers wait for rejection to push for new lows. The red lines show today’s average daily range.

Upcoming Catalysts

Tomorrow, we anticipate data on the Australian Labour Market, US Retail Sales, and US Jobless Claims.

`