Fundamental Overview

The US Dollar is strengthening this week, even without significant economic data or higher Treasury yields.

Investor Stanley Druckenmiller noted that some stocks suggest the market is preparing for a potential Trump victory.

This anticipation may be boosting the USD, as it typically rises on expectations of growth and fewer rate cuts. However, not all markets align with this outlook, indicating it might just be temporary fluctuations.

Today’s US retail sales and jobless claims figures will likely impact the market. Key events are anticipated in November, including the October data and the US elections.

For the AUD, the Australian labor market report exceeded expectations today. While it didn’t alter interest rate predictions significantly, it supports the RBA’s aggressive stance.

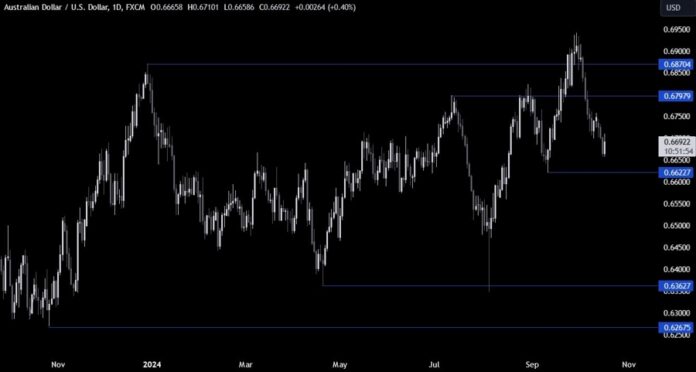

AUDUSD Technical Analysis – Daily Timeframe

The daily chart shows AUDUSD nearing the 0.6622 level. If it reaches this point, buyers may enter with defined risk just below, targeting a rise back to 0.68. Conversely, sellers will aim for a break below to push towards 0.64.

AUDUSD Technical Analysis – 4 Hour Timeframe

On the 4-hour chart, the price is rising above a downward trendline, although sellers may defend the 0.67 mark. If buyers break through, there may be a bounce to 0.6750.

AUDUSD Technical Analysis – 1 Hour Timeframe

The 1-hour chart highlights the surge after the strong Australian jobs report. Buyers aim for a break above 0.67, while sellers will likely push against this level to drive prices lower. The red lines indicate today’s average daily range.

Upcoming Catalysts

Today, important US Retail Sales and Jobless Claims data are expected to be released.