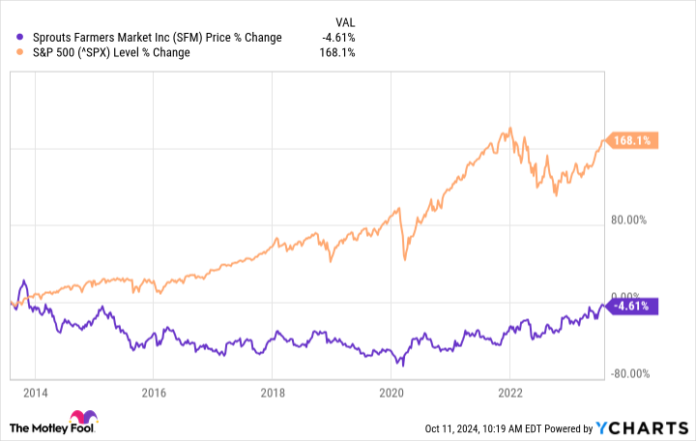

In August 2013, Sprouts Farmers Market (SFM -0.69%) went public with an IPO, becoming a highlight that year with shares more than doubling to around $40 on the first day. However, by August 2023, the stock price was roughly $38, showing little change over a decade while the S&P 500 outperformed it.

Despite this lackluster performance, Sprouts’ stock has surged about 200% in the year following its 10-year anniversary as a public company. Here’s why…

Why Sprouts is Thriving

Sprouts Farmers Market operates 415 stores focusing on fresh produce and healthy foods. In the first half of 2024, revenue increased by 10%, with an operating margin around 7%, which is impressive for a grocery chain.

Despite this growth, Sprouts’ stock lagged for many years. Over time, the company’s valuation dropped, leading to share buybacks that reduced the share count and increased earnings per share (EPS). Finally, investors are recognizing the positive developments at Sprouts.

SFM EPS Diluted (TTM) data by YCharts.

Future Outlook for Sprouts

Sprouts plans to open over 100 new grocery locations, which is expected to boost revenue. Additionally, same-store sales growth of 4% to 5% is anticipated this year, supporting continued double-digit revenue growth in the following years.

The company is also debt-free, enhancing its appeal as a safer investment. While it’s unlikely that the stock will triple again soon, investors can expect gradual growth as the company continues to perform well.

`