In August 2013, Sprouts Farmers Market (SFM -0.69%) had a successful IPO, with shares more than doubling on the first day. LinkedInís 2011 IPO was considered a high point, making Sprouts’ debut particularly notable.

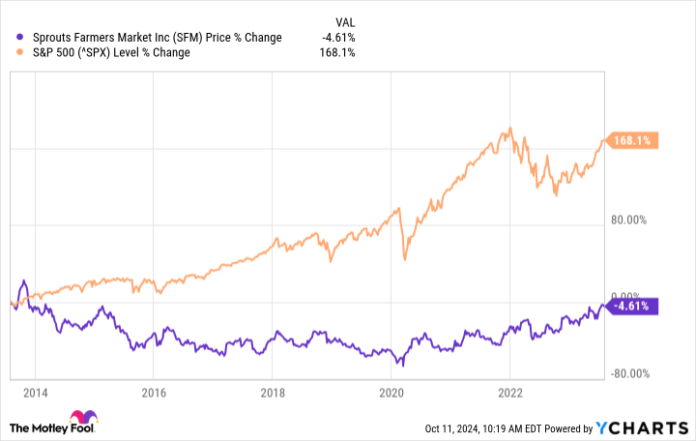

Fast forward to 2023, and Sprouts’ stock price was about $38, meaning it had barely moved in a decade and significantly lagged behind the S&P 500. However, in the last year, Sprouts shares jumped around 200%, reversing a decade of stagnation.

Why Sprouts is Thriving

Sprouts operates 415 stores specializing in fresh produce and healthier packaged foods. In H1 2024, revenue rose 10% with a 7% operating margin, outperforming many grocery competitors. Despite consistent financial growth, the stock price remained low, prompting management to buy back shares.

Thanks to these buybacks, Sprouts reduced its share count while increasing earnings per share (EPS). This makes it more attractive to investors now recognizing the company’s potential.

SFM EPS Diluted (TTM) data by YCharts.

Investors were patient, allowing for a delayed response to Sprouts’ growth. This highlights an important lesson: long-term business fundamentals often prevail in the market.

Future Prospects for Sprouts

Sprouts plans to open over 100 new locations, leading to expected revenue growth. Management anticipates 4% to 5% same-store sales growth this year, indicating potential for sustained growth in revenue.

Additionally, Sprouts is now debt-free and has consistently posted positive operating income, which could enhance profitability going forward.

While the stock may not triple again next year, ongoing growth should positively impact its price. After years of stagnation, those who remain patient may ultimately benefit as the business fundamentals improve.