Last week, several Wall Street analysts became more optimistic about three stocks ahead of their earnings reports: Meta Platforms, Sea Ltd, and Barrick Gold.

Meta Platforms

Twelve analysts raised their price targets for Meta, the parent company of Facebook, Instagram, and WhatsApp. The average target suggests a 4% increase potential due to a strong 64% rise in stock this year. One bullish analyst sees a target of $780, indicating a 35% upside over the next year, citing increased sales, profits, and AI-driven cost efficiencies. Meta released the advanced AI chatbot Llama 3 in April. Analyst Jeffrey Wlodarczak stated, “We feel confident Zuckerberg can successfully lead META forward.”

Sea Ltd

Ten analysts increased their price targets for Singapore-based Sea Ltd, owner of the Shopee e-commerce platform and Garena gaming and fintech services. However, the average price target suggests the stock is fairly valued after a 144.35% rise this year, with analysts maintaining a “neutral” rating. Analyst Helena Wang warned that while Sea has long-term potential, it faces challenges from increased competition.

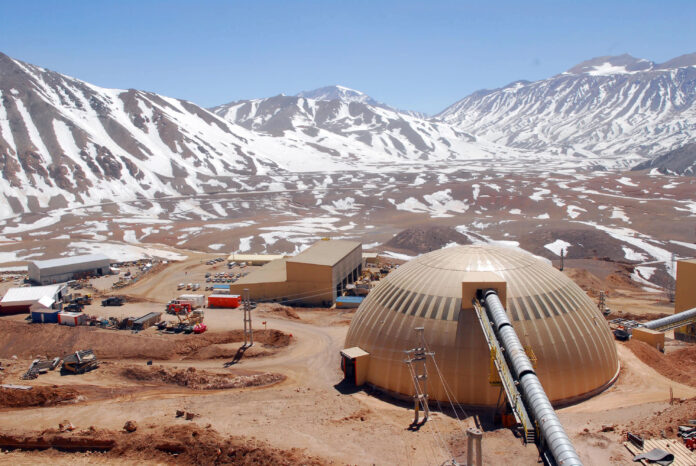

Barrick Gold

Ten analysts raised their forecasts for Barrick Gold, with an average 18% upside potential. However, analysts were disappointed by the company’s recent earnings outlook, which predicted struggles to meet sales and cost forecasts. The stock�s performance is closely tied to gold prices.